The Terra ecosystem is a blockchain protocol that deploys decentralized stablecoins (crypto coin pegged to the dollar, e.g. 1UST = 1USD). Stablecoins are extremely crucial for the crypto community because it adds a layer of security to a highly stable asset. Decentralization is cool because it avoids the strings of the government.

The product of Terra is UST, a decentralized stablecoin with no collateral. The mechanism that makes the stablecoin work without any money baking it up (collateral) is an algorithm, UST can only be created by burning (destroying) LUNA and can only be burned (spent) by creating LUNA. So LUNA is a primary token (like ETH, or BTC) that is linked to the value of the stablecoin (UST). The collateral of the stable coin is the value of the underlying chain (Terra), which was thriving until recently due to a 20% interest rate for users buying LUNA and staking (which basically means putting on a protocol and promise not to sell). This high-interest rate brought a lot of attention of retail users (individual people, not funds).

This results in a complicated algorithm with a lot of financial implications and possible inflation, which is complex to explain in a post about fofoca. Know that all other attempts to make this work have failed, and there’s a general understanding that the hope to make decentralized stable coins is a fundamentally flawed assumption.

What’s the problem? The risk of de-pegging, which is the UST (stable coin) not being equal to the dollar, creating fear in people that the value will not return to the appropriated value, triggering a bank run of investors trying to collect gains, plugging the price of the coin even more. This is called the death spiral and was already deployed on regular financial markets. How big is this? In the last months, there were around 3B of UST invested.

At the beginning of May of 2022, someone attacked the protocol in the molds of the Soros black wednesday attack. With 100000 BTC, an undisclosed player was able to disrupt the market and create a bank run on Terra’s ecosystem. The fuse was the UST losing its pegg to the dollar, triggering the bank run.

And LUNA, the sister coin, tied to UST:

Word on the street is that the attacker was able to profit 800 million of dollars by shorting the market.

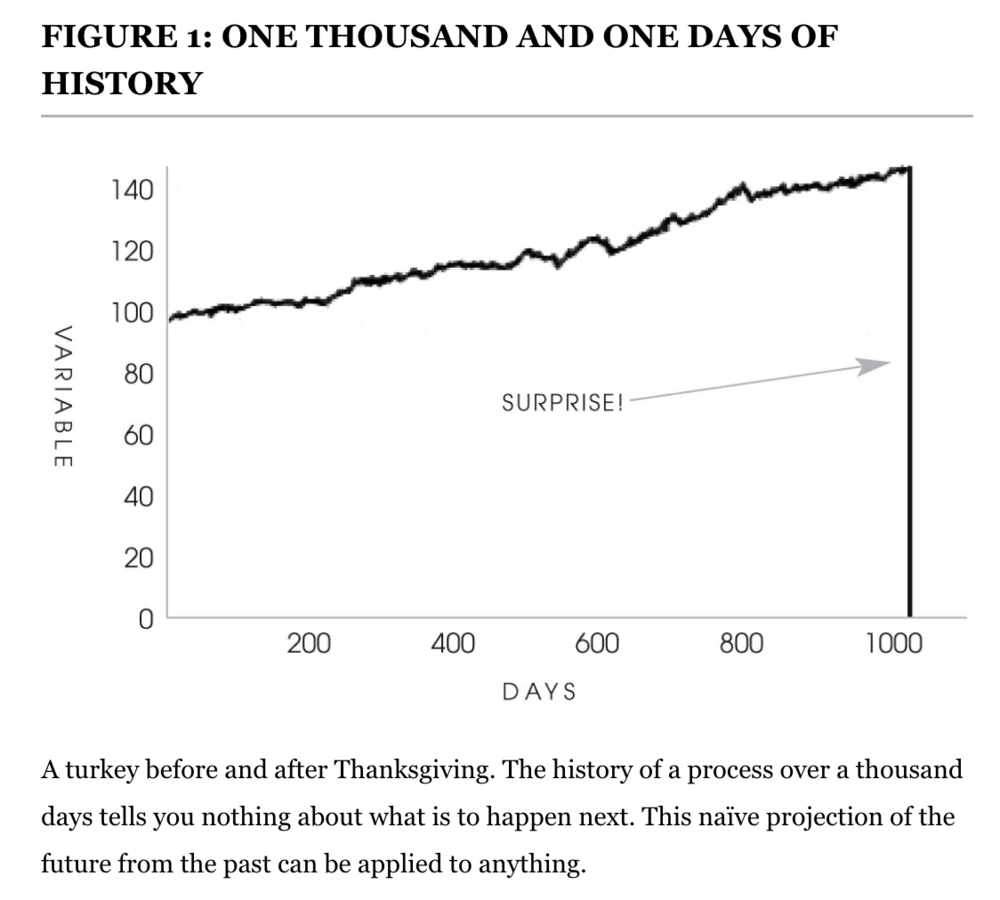

Crypto folks usually talk about the Lindy Effect, which is about the life expectancy of non-perishable things. The effect says that the longer a period something has survived to exist or be used in the present, it is also likely to have a longer remaining life expectancy. However, trusting blindly in this theory makes you susceptible to surprising events: